GST Registration Services Hyderabad – Fast & Hassle-Free Online Filing

Are you starting a new business or expanding your operations in Hyderabad? Get legally compliant with quick and reliable GST Registration services in Hyderabad through Invention Tax Solutions. Whether you’re a trader, freelancer, eCommerce seller, or service provider, our team ensures you get your GSTIN without any delays.

Why GST Registration is Mandatory in Hyderabad

Goods and Services Tax (GST) is a unified indirect tax system applicable across India. If your turnover exceeds the prescribed threshold or you’re engaged in inter-state supply, GST registration is mandatory.

Hyderabad, being a major trade and tech hub, has thousands of GST-registered businesses. Stay competitive and compliant by registering your business today.

Benefits of GST Registration

- Legal Authorization to Collect GST

- Eligibility to Claim Input Tax Credit (ITC)

- Improved Business Credibility

- Mandatory for Online Sellers (Amazon, Flipkart, etc.)

- Required for B2B Contracts and Tenders

- Enables Seamless Interstate Business

Registering under GST is a legal necessity and a smart business move for growing enterprises.

Who Should Register for GST?

- Businesses with annual turnover above Rs. 40 Lakhs (Rs. 20 Lakhs for services)

- Inter-state suppliers

- E-commerce sellers & aggregators

- Freelancers & consultants

- Exporters and importers

- Casual taxable persons

- Non-resident taxable persons

Documents Required for GST Registration in Hyderabad

Here’s what you’ll need:

For Proprietorship:

- PAN Card & Aadhaar Card of proprietor

- Passport size photo

- Address proof (electricity bill, rent agreement)

- Bank account details

For Partnership / LLP / Pvt Ltd:

- PAN & Aadhaar of partners/directors

- Firm/Company PAN

- Certificate of Incorporation (for companies)

- MOA & AOA (for Pvt Ltd)

- Partnership deed (for firms)

- Digital Signature Certificate (DSC)

How We Help with GST Registration

At Invention Tax Solutions, we offer complete support from start to finish:

- Free Consultation to assess your GST applicability

- Document Collection and Review

- Application Filing on GST Portal

- Handling Clarifications or Rejections (if any)

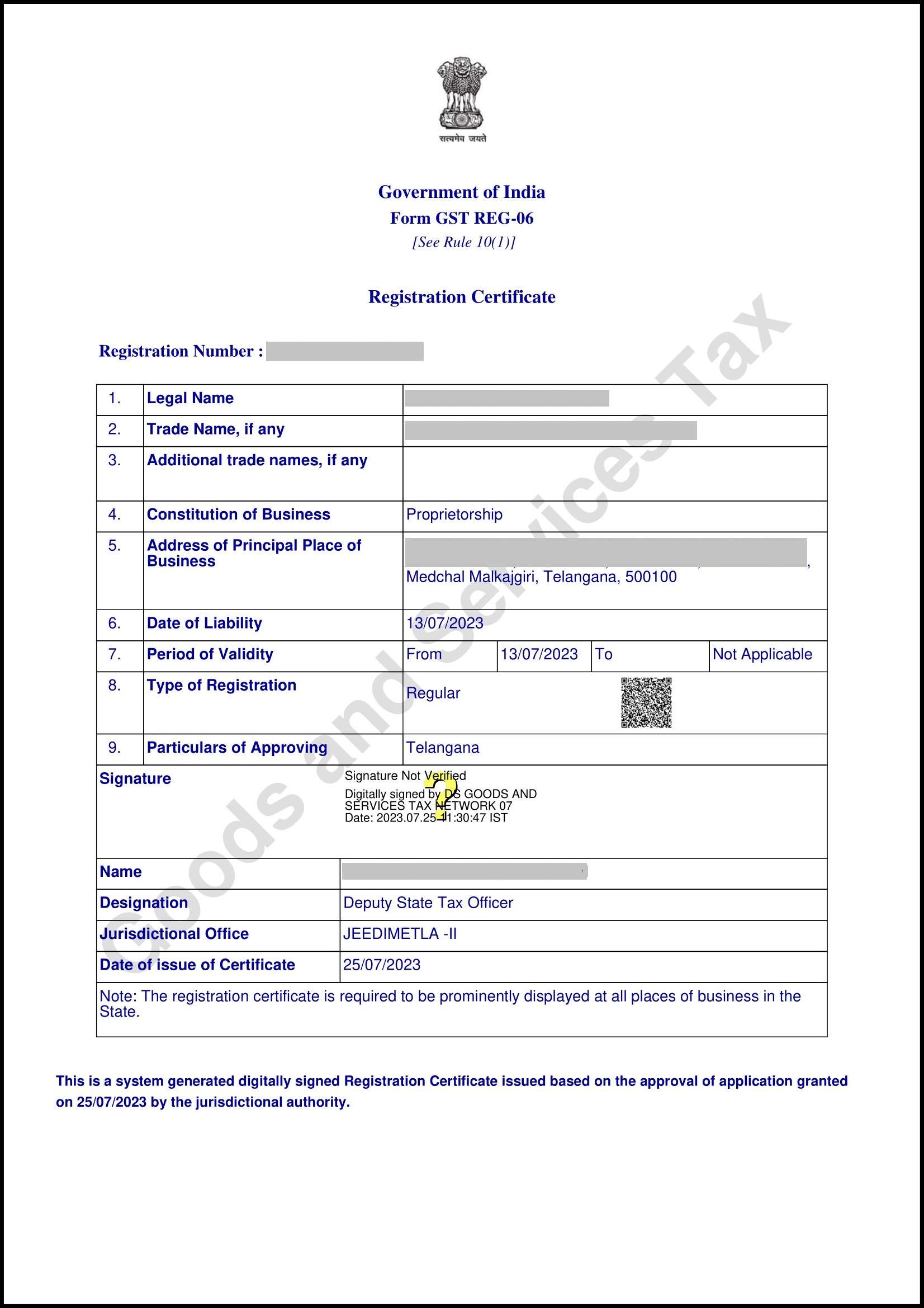

- Obtaining and Sharing GSTIN Certificate

- Post-registration Support (GST Return Filing, Amendments, etc.)

Our GST Registration Process – Step-by-Step

- Get in Touch via call or WhatsApp

- Send Required Documents securely online

- We File the Application within 24 hours

- Get GST Number (GSTIN) typically within 2–4 working days

- Download Your GST Certificate and start billing legally

Why Choose Invention Tax Solutions?

- 10+ Years Experience in Tax & Compliance

- Fast Processing with Expert Team

- Error-Free Filing Guaranteed

- Affordable Pricing – No hidden charges

- Trusted by 1000+ Hyderabad Businesses

- One-Stop Business Support

Real-Life Success Story

Client: Reddy’s Electronics (Kukatpally)

They started a mobile retail store and needed GST urgently to claim input tax and sell through Amazon. We registered their business in 2 days, with no hassle.

“Great service! Fast, smooth, and professional. Thanks to Invention Tax Solutions, we started selling online in record time.”

Frequently Asked Questions (FAQs)

1. What is GST registration?

It is the process of registering your business under the Goods and Services Tax Act to obtain a unique GSTIN.

2. Is GST registration mandatory?

Yes, if your turnover exceeds the limit or if you are an e-commerce seller or inter-state supplier.

3. How long does GST registration take?

Generally 2–4 working days if all documents are in order.

4. Is there any government fee for GST registration?

No. GST registration is free. We only charge a small service fee for our professional help.

5. Do I need a GST number for online sales?

Yes, eCommerce sellers on platforms like Amazon, Flipkart, and Meesho must have a GSTIN.

6. Can I apply for GST without a shop?

Yes, you can apply using your residential address as the place of business.

7. What happens after getting GST registration?

You can start issuing tax invoices and must file monthly or quarterly GST returns.

8. Do you help with GST return filing?

Yes. We provide complete GST compliance, return filing, and advisory services.

9. What is composition scheme in GST?

It’s a simplified tax scheme for small businesses with turnover under Rs. 1.5 Crores.

10. Can I cancel or amend my GST registration?

Yes. We help with modifications, cancellations, and rectifications too.

Internal Links to Related Services

- MSME Registration in Hyderabad

- Partnership Firm Registration in Hyderabad

- Food License Registration in Hyderabad

- Trade License Registration in Hyderabad

- Trademark Registration in Hyderabad

Register for GST Today with Invention Tax Solutions

Avoid legal trouble and boost your business credibility with fast and accurate GST Registration in Hyderabad. Our experts handle everything so you can focus on your business.

Call Now: +91-7993132530

Email: contact@inventiontax.com

Visit: www.inventiontax.com

Click “Buy Now” and get your GSTIN in just a few days!