Home » LLP Registration

LLP Company Registration in India – A Complete Guide

If you’re planning to start a business and want the flexibility of a partnership combined with the limited liability of a company, LLP company registration in India is the perfect choice.

A Limited Liability Partnership (LLP) offers entrepreneurs the best of both worlds — it’s simple to form, cost-effective, and provides protection to partners against business debts. It has become the preferred legal structure for startups, consultants, and professional firms across India.

Introduced under the Limited Liability Partnership Act, 2008, LLPs bridge the gap between a traditional partnership and a private limited company. The structure ensures minimal compliance burden while granting a distinct legal identity to the business.

In this comprehensive guide, we’ll walk you through everything — from the meaning and advantages of an LLP to the registration process, documents, taxation, compliance, and FAQs — ensuring you have complete clarity before registering your LLP in India.

What Is an LLP (Limited Liability Partnership)?

An LLP is a hybrid form of business entity that combines the operational flexibility of a partnership firm with the legal protection of a company. It is a separate legal entity, distinct from its partners, meaning it can own property, enter into contracts, and be sued or sue in its own name.

Key Features

Separate Legal Entity: LLP is legally independent of its partners.

Limited Liability: Partners’ liability is limited to their contribution.

Perpetual Succession: The LLP continues even if partners change.

No Minimum Capital Requirement: You can start with any amount.

Tax Efficiency: LLPs are taxed as partnership firms, not companies.

Example:

Imagine two friends — Rakesh and Suman — start a consultancy business. They don’t want personal assets at risk if the business incurs debts. By opting for LLP company registration in India, they enjoy limited liability and flexibility in management.

Why Choose LLP Over Other Business Structures?

Many entrepreneurs prefer LLPs for their simplicity and legal protection. Here’s how LLPs stand out compared to other business types:

| Feature | LLP | Private Limited Company | Partnership Firm |

|---|---|---|---|

| Legal Status | Separate entity | Separate entity | Not separate |

| Liability | Limited | Limited | Unlimited |

| Compliance | Moderate | High | Low |

| Ownership Transfer | Easy | Moderate | Difficult |

| Taxation | 30% | 30% | Individual |

| Minimum Members | 2 partners | 2 directors | 2 partners |

| Ideal For | Startups, professionals | Growing companies | Small traders |

Benefits of LLP Company Registration in India

1. Limited Liability Protection

Partners are only liable for their agreed contribution. Personal assets remain protected.

2. Separate Legal Identity

The LLP can own assets and enter contracts in its name, making it more credible in business dealings.

3. Flexible Management

There are no rigid corporate formalities — partners have freedom to define internal management structure.

4. Low Compliance Costs

Compared to private limited companies, LLPs have lower compliance requirements and costs.

5. No Minimum Capital

You can start with as little as ₹1,000 — there’s no mandatory capital limit.

6. Easy Conversion

Existing partnerships or private limited companies can be converted into LLPs with ease.

Eligibility Criteria for LLP Registration

To register an LLP in India, ensure the following conditions are met:

Minimum Partners: 2 (Designated Partners)

No Maximum Limit on the number of partners

At least one Designated Partner must be a resident of India

Partners must have DPIN (Designated Partner Identification Number)

A registered office address within India

Documents Required for LLP Company Registration in India

For Partners

PAN Card of all partners

Aadhaar Card / Voter ID / Passport / Driving License

Passport-size photographs

Address proof (electricity bill, rent agreement, etc.)

For Registered Office

Rental agreement / property ownership proof

Latest utility bill (not older than 2 months)

NOC from the owner (if rented)

Other Documents

Digital Signature Certificate (DSC) of partners

LLP Agreement (drafted after registration approval)

Step-by-Step Process for LLP Company Registration in India

Here’s the detailed process to register your LLP easily and legally:

Step 1: Obtain Digital Signature Certificates (DSC)

Every partner must obtain a DSC to digitally sign e-forms submitted on the MCA (Ministry of Corporate Affairs) portal.

Step 2: Apply for Director Identification Number (DPIN/DIN)

Each designated partner needs a DPIN, which can be obtained through the SPICe+ (MCA) portal.

Step 3: Reserve LLP Name

Apply for name reservation using the RUN-LLP (Reserve Unique Name) form.

The name must be unique and end with “LLP”.

Example: BrightEdge Consulting LLP

Step 4: File Incorporation Form (FiLLiP)

Submit the FiLLiP form on the MCA website with:

Details of partners

Registered office address

Proof of identity and DSC

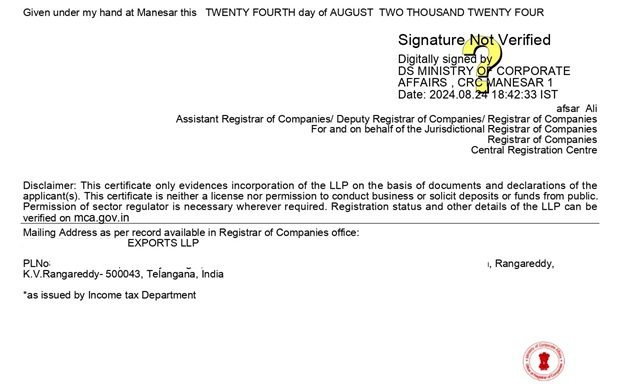

The MCA will verify and issue the Certificate of Incorporation (COI) upon approval.

Step 5: Draft and File LLP Agreement

After incorporation, partners must draft an LLP Agreement that defines:

Roles and responsibilities of partners

Profit-sharing ratio

Management rights

It must be filed with the Registrar in Form 3 within 30 days of incorporation.

Step 6: Apply for PAN, TAN, and Bank Account

Once the LLP is incorporated, apply for a PAN and TAN. Then, open a current account in the LLP’s name.

Time and Cost for LLP Registration

| Particulars | Estimated Cost (₹) | Time Required |

|---|---|---|

| DSC & DPIN | 1,500 – 2,000 | 1–2 days |

| Name Reservation | 200 | 1–2 days |

| Incorporation (FiLLiP) | 500 – 1,000 | 5–7 days |

| LLP Agreement | 1,000 – 3,000 (stamp duty varies) | 2–3 days |

| Total Estimated Cost | ₹5,000 – ₹10,000 | 10–15 working days |

Compliance Requirements for LLPs

Although LLPs have less compliance compared to companies, certain filings are mandatory:

1. Annual Return (Form 11)

Filed within 60 days of the end of the financial year.

Includes partner and capital contribution details.

2. Statement of Accounts & Solvency (Form 8)

Filed annually before 30th October.

Reflects the financial position of the LLP.

3. Income Tax Return

Must be filed annually before 31st July (if audit not required).

Tax Rate: 30% plus cess and surcharge.

4. Audit Requirements

Mandatory if turnover exceeds ₹40 lakhs or capital exceeds ₹25 lakhs.

Taxation of LLPs in India

LLPs are taxed as partnership firms under the Income Tax Act, 1961.

| Component | Details |

|---|---|

| Income Tax Rate | 30% |

| Surcharge | 12% (if income > ₹1 crore) |

| Health & Education Cess | 4% |

| Alternate Minimum Tax (AMT) | 18.5% |

Tip: LLPs enjoy exemptions from Dividend Distribution Tax (DDT) — making them more tax-efficient than companies.

Advantages of LLP Over Private Limited Company

Lower setup and compliance cost

No mandatory audit unless turnover exceeds threshold

No restriction on profit distribution

Fewer ROC filings and penalties

Example:

A small architectural firm in Hyderabad earns ₹25 lakh per year. By registering as an LLP, they save nearly ₹50,000 annually in compliance costs compared to a Private Limited Company.

Disadvantages of LLP

Not ideal for large-scale businesses seeking funding.

Conversion into a company is time-consuming.

Penalties for late filing can be high (₹100 per day).

Difficult to attract venture capital investors.

Common Mistakes to Avoid During LLP Registration

Choosing a name that conflicts with existing trademarks.

Failing to file the LLP Agreement within 30 days of incorporation.

Not maintaining proper financial records.

Missing annual return deadlines.

Using a residential address without proper NOC from the owner.

Best Practices and Expert Tips

Hire a professional CA/CS for documentation and compliance.

Use digital tools for bookkeeping and GST filing.

Maintain separate bank accounts for transparency.

Ensure timely filing of all MCA and tax forms.

Keep copies of all ROC acknowledgments for future reference.

Real-Life Example: Startup Success through LLP

Case Study: TechGrow Consulting LLP (Bangalore)

In 2020, two IT professionals launched TechGrow Consulting LLP to offer software services.

They chose the LLP model for:

Legal protection and brand credibility.

Easy onboarding of new partners.

Tax efficiency.

Within three years, they expanded operations to multiple states, and their LLP registration helped them win government and corporate contracts that required legal business proof.

When Should You Convert LLP to a Private Limited Company?

You should consider conversion if:

You plan to raise venture capital.

You want to issue ESOPs to employees.

Your turnover exceeds ₹2 crore annually.

You need global expansion and corporate recognition.

Internal Linking Suggestions

You can include links to related pages such as:

These links improve SEO interconnectivity and guide users through related services.

Frequently Asked Questions (FAQs)

1. What is the minimum capital for LLP company registration in India?

There is no minimum capital requirement. You can start an LLP with any amount of capital as decided by the partners.

2. How many partners are required to form an LLP?

A minimum of two partners is mandatory, and there’s no upper limit on the number of partners.

3. Is audit compulsory for LLPs?

No. Audit is required only if the turnover exceeds ₹40 lakhs or capital contribution exceeds ₹25 lakhs.

4. How long does it take to register an LLP in India?

Generally, it takes 10–15 working days, depending on name approval and document verification.

5. Can a foreigner become a partner in an LLP?

Yes. Foreign nationals and NRIs can become partners, provided one designated partner is an Indian resident.

Conclusion: Start Your LLP Company Registration in India Today

In conclusion, LLP company registration in India is one of the most efficient, affordable, and legally secure ways to start a business. It offers flexibility, credibility, and limited liability — making it ideal for startups, professionals, and small enterprises.

With simple registration, minimal compliance, and tax advantages, an LLP is a smart choice for entrepreneurs aiming for sustainable growth.

At Invention Tax Solutions, we simplify the entire process — from LLP registration and documentation to compliance management and tax filing.

📞 Get in touch today to register your LLP seamlessly and turn your business idea into a legal entity in just a few days!